Rocky Mountain Instrument Co.

By Eric Peterson | Dec 13, 2017

Company Details

Location

Lafayette, Colorado

Founded

1957

Ownership Type

Private

Employees

200 (145 in Colorado)

Products

Laser optics and systems

Lafayette, Colorado

Founded: 1957

Privately owned

Employees: 200 (145 in Colorado)

Industry: Electronics & Aerospace

Products: Laser optics and systems

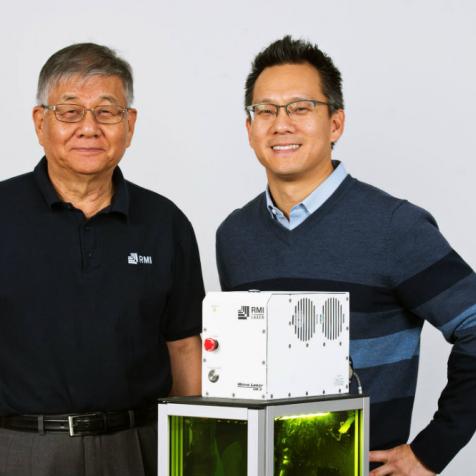

The father-son team of Dr. Yubong and Steve Hahn are guiding the laser optics pioneer into new markets with a vertically integrated photonics platform.

With a seven-decade history that spans four Boulder County cities, two continents, multiple industries, and a broad swath of the laser spectrum, Rocky Mountain Instrument Co. (RMI) continues to innovate.

When the company incorporated in the 1950s, RMI began as an industrial components manufacturer in the orbit of companies like Ball Aerospace & Technologies. Thin-films expert Yubong bought the business in 1983 after working at CVI Laser Optics, an Albuquerque-based manufacturer he started with his brother, Dr. Haggie Hahn.

"His brother continued [at CVI] and my father moved up to Boulder," says Steve, Yubong's son and RMI's CEO. "When we took [RMI] over, it was six people in a little house in Lyons," says Steve. "He transformed it into a laser optics manufacturer."

The company's trajectory making lenses paralleled Boulder County's rise as a national laser optics hub. Steve dubs it one of the industry's "big six" regions, along with Southern California; Arizona; Rochester, New York; Orlando; and Boston.

Whereas CVI was focused on optics for high-powered lasers, RMI cast a wider net for "other regions in the laser spectrum," says Steve. ”[Yubong] used Rocky Mountain Instrument as a vessel for that. We branched out into infrared, ultraviolet, and other laser optics."

After working for startups in Silicon Valley, Steve joined the family business in 2000. "When the dot-com bubble burst, I made the decision to move back from Colorado," he says.

Steve took over from his father as CEO in 2010; Yubong is now RMI's chief scientist. "We're a father-son team," says Steve.

The company has evolved into a turnkey manufacturer with "the ability to provide engineering services for clients, rather than just being an optical job shop," says Steve. "We've beefed up our in-house engineering talent and CAD capabilities."

"We play in five major verticals: medical, semiconductor, industrial, scientific instruments, and aerospace and defense," says Steve. "Our business is split evenly among the five."

The diverse customer base allows for a more bust-resistant business model. "Defense is quite cyclical, and semiconductor is quite cyclical as well," says Steve, noting that volatility in those industries is balanced by "steady" sales of laser optics to medical, industrial, and scientific customers.

In 1997, the company moved from Longmont to a 90,000-square-foot location it built in Lafayette. The facility is home to one of the world's largest optical coating operations, with 18 different coating chambers, and an industry-leading catalog of advanced materials and techniques.

With the move to Lafayette, RMI launched RMI Laser, a subsidiary company that manufactures complete laser systems. "RMI Laser specializes in laser marking and etching for precision parts marking and traceability programs," says Steve, identifying aerospace, medical, and industrial as key markets. Located at the same facility as its parent company, RMI Laser employs about 40 of the total operation's 145 Colorado employees.

This horizontal expansion in the laser market was followed by a vertical one: In 2012, RMI opened a plant in South Korea to make zinc selenide substrates for coatings to combat a notably finite supply chain. "The main driver was that it's a substrate in limited supply," says Steve.

The fabrication, coating, and assembly of optics and systems continues to take place in Lafayette. RMI also develops "integration-friendly software” for its systems in-house, says Steve.

On the RMI Laser side of the operation, Steve sees potential for growth through differentiation, customization, and miniaturization. "The standard laser-marking business has been saturated with low-cost competitors," he says.

In response, RMI Laser offers "fully custom parts-marking rigs" that can cost up to $125,000. "It's actually an engineering play," says Steve.

Coming in 2018: Yorz Laser, a new compact marking system for the consumer and commercial markets. "We believe they're the smallest laser marking systems on the market," says Steve. The MSRP for a single unit is about $15,000.

Steve characterizes RMI's pathway to date as "slow, organic growth," and adds, "I think it would have been possible to grow faster with outside capital and one product line."

However, the strategy involves a longer-term play: The company's decades-long reinvestment strategy is setting the stage for future growth. "We're building a photonics platform here," says Steve. "It's been 34 years, a long build cycle, but we've built a platform that can explore different opportunities in laser systems and optical components. With that platform, we can pick and choose which areas we want to go into."

Challenges: "The biggest challenge is international competition," says Steve. Manufacturers in China and other countries "are flooding the market with lower-cost systems."

He adds, "The challenge is to innovate into areas where we don't foresee as much competition from overseas. It forces us to be better."

Opportunities: Growth in exports. RMI's market is currently about 70 percent domestic and 30 percent international, says Steve, but he sees potential for growth in the latter. "As those foreign markets become much more developed, they're developing appetites for higher-end, higher-technology products." Manufacturing-heavy countries in Eastern Europe are fertile for RMI Laser, while the optics are in demand in Japan, China, and Western Europe.

The aforementioned Yorz line of compact marking lasers represent a big opportunity "breaking into consumer and commercial markets," Steve adds. "Advanced manufacturing technology is making its way into mass consumer applications. You see that happening with 3D printing. I think lasers are going to be right there next."

"I think the big opportunities are going to play into our innovations," he notes. "It's really the flip side of the challenges."

Needs: "Space, we're quite comfortable," says Steve. "Workforce, we're quite comfortable -- we've developed a strong training network."

That leaves funding. While RMI has never brought in investors and remains family-owned, "Now we're going to start looking at outside capital to more rapidly grow one or all of our divisions," says Steve, describing a need for "access to flexible capital for entrepreneurs and small- to medium-sized businesses” for equipment upgrades and employees. "There's definitely a limit to those kinds of capital."