Special Report: Ag Tech in Colorado

By Eric Peterson | May 26, 2015

From soil to seed to farm to table, an innovation revolution is redefining how we produce food, and Colorado is part of the journey every step of the way.

People are taking notice. The New York Times took note of Colorado's farmers use of drones to survey their cropland. An NPR story recently asked if the state was the "Silicon Valley of agriculture."

Whether it's the Silicon, Yosemite, or Napa valley of ag tech or not, it's a hell of an ecosystem.

Take a look around. We have Colorado State University, on the bleeding edge of ag research, and research entities developing revolutionary new strains of potatoes and wheat. We have big corporate headquarters and huge production facilities. We have craft producers of all kinds and some of the most innovative manufacturers in food and ag -- Birko, Infinite Harvest, Wadsworth Controls, and PureVision Technology, to name a few.

We also have Boulder, the 50-yard line of the natural foods industry, and Denver, center court for cannabis, and capital flowing in from the coasts.

A Nov. 2014 CSU report titled "Colorado's Innovation Cluster in Agriculture and Food" painted a pretty impressive picture, identifying more than 500 food and ag innovators in the state's public and private sectors. The number of patents and jobs are on notable upswings.

From 2008 to 2013, "Colorado's total manufacturing jobs dropped 6.7 percent," says Tim Larsen, senior international marketing specialist with the Colorado Department of Agriculture. "Food and beverage processing increased 8 percent."

"It isn't just what's happening in Yuma County," he adds. "It's what's happening on the Front Range as well."

And it's also Colorado sitting pretty on top of a national trend. About $2.4 billion of venture capital went into ag tech in 2014. That's a quarter-billion more than cleantech attracted.

Boosting margins

As agriculture gets more efficient through innovation, the notoriously tricky math of farming changes. Larsen says GPS-guided tractors plant such precise rows of corn that production can increase by 2 percent.

"If you're working on 8 percent margins and you can add 2 percent, that means your profit went up 25 percent," he says. "What wouldn't any corporation do to increase net profit by 20 to 25 percent?"

It's these kinds of impacts that are leading Colorado's farmers and ranchers to embrace leading-edge technology of all kinds. These are no country bumpkins, says Larsen. "They're mad scientists,"

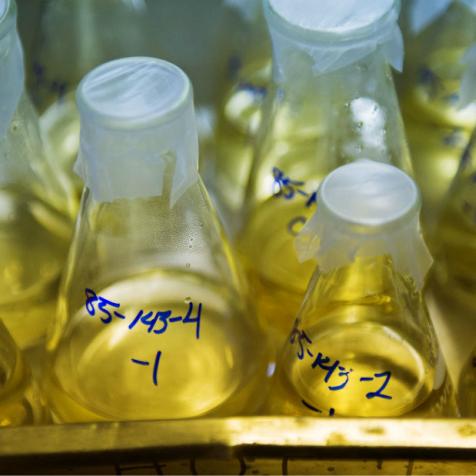

He highlights Bayfield-based M&R Durango, selling natural spores that infect grasshoppers but not grain; Wellington's Keeton Industries, winner of the Governor's Award for Agricultural Exporting for shipping probiotic microbes to aquaculture operations worldwide; the Colorado Certified Potato Growers Association's export of Purple Majesty biomaterial to Scotland in order to comply with trade laws banning seed; and Aristocrat Angus, which has mastered on-farm embryo transfer in cattle in Platteville and sells to an international market.

From the Four Corners to the San Luis Valley to Northern Colorado, this is some seriously high-tech innovation, from the massive to the microscopic. The scope could grow: Recent news that $250 million of state funds are pegged for new CSU facilities at the National Western Complex, if Denver can raise the remainder of the nearly $1 billion tab for redevelopment.

Larsen says that such public-private partnerships have raised the state's game, pointing to the potato industry as well corn and wheat.

"The wheat people have done an amazing job," he says. He highlights the development of the Snowmass strain, a white wheat that has whole-wheat nutrition, by the Colorado Wheat Research Foundation. Released to farmers in 2010, Snowmass now accounts for about 5 percent of the state's total wheat acreage.

Larsen says the foundation has been a "wonderful" collaboration between the state and growers and was critical in luring Ardent Mills' 200-employee headquarters to Denver in 2014. The joint venture between ConAgra and Cargill is the largest flour-milling operation in the U.S.

Ardent Mills COO Bill Stoufer says the Colorado location allows the company to "tell a story" to visiting customers by taking them to CSU and local farms and facilities. "In a day, you go from the farm to research to a milling plant to a manufacturing operation," he explains. "These things just started jumping off the page at us."

Eyes in the sky

Unmanned aerial vehicles (UAVs), commonly called drones, are yet another area where Colorado agriculture is taking the lead. It's all about economies of scale. "To be successful in dry-land farming, you better have a lot of acreage," says Larsen. "They have to go big."

Boulder-based Agribotix has deployed about 30 UAVs to ag customers all over the world. "Every time we turn over a rock, we find another application," says CEO Tom McKinnon.

Users can use infrared photography to detect which crops need water, fertilizer, or fungicide, or use high-resolution imagery and machine vision to increase crop yields by as much as 10 percent. And it's affordable for small farmers: Agribotix's turnkey UAV systems start at $6,600.

McKinnon rattles off a list of Colorado UAV makers that includes Aspect Robotics, Leptron, and Falcon Unmanned, and noting a focus on local and national security applications. "We're the only one specifically targeting agriculture," says McKinnon.

As the FAA loosens its stranglehold on commercial drones -- the agency has granted hundreds of exemptions to its blanket ban -- federal rule-making for UAVs has entered a legislative phase. McKinnon says he expects the ban will be lifted in 2017 and the market will go from overdrive to warp.

Backyards, cannabis & looking back

The consumer is another market driver in Colorado. The growing demand for all things local has been a catalyst for the state's agriculture, as well as gardening and the so-called "urban homesteading" movement. Americans have spent in excess of $30 billion on gardening in recent years, and the surge in consumer interest has driven innovation in agriculture manufacturing locally.

The movement has made way for upstart Colorado manufacturers like AKER, making backyard beehives, chicken coops, and composting bins, and Waste Farmers, crafting soil products for home gardeners -- as well as Colorado's booming cannabis industry.

John-Paul Maxfield, founder and CEO of Jefferson County-based Waste Farmers, says Colorado agriculture is also getting a big lift from the cannabis industry, and vice versa, but the relationship could be leveraged even more. "We are evolving a great ecosystem in Colorado," he notes. "Cannabis does play a role in that."

Cannabis growers should diversify and grow other things and traditional farmers should diversify into cannabis, Maxfield argues. He cites a grower who went from pot to tomatoes with great success. "Hopefully, we can be a bridge."

Waste Farmers doubled sales in 2014 by growing in both the cannabis and gardening markets with its Batch 64 and Maxfield's soil products that "maximize nutritional density" over plant size, says Maxfield, with a balance of cobalt, manganese, calcium, and other nutrients.

Maxfield says he hopes big ag companies come over to his way of thinking, that nutrition is more important than tonnage. "I think they're very interested, but it's hard to turn big organizations around," he says.

The Maxfield's brand will expand from garden to table in 2016 when the company introduces a line of food products.

Here, the big innovation is not about miniscule microbes or tech-savvy mega-farms. "A lot of innovation is looking back," says Maxfield. "There are 80,000 edible plants. Modern agriculture focuses on 200 of them."

Amaranth is one of the forgotten edible plants that's sure to be an ingredient for the upcoming line. Maxfield says the protein-rich, gluten-free Aztec staple has more potassium than bananas and more iron than broccoli.

And it grows wild in Denver. "I was riding my bike in my neighborhood and I saw it growing by a stop sign," he says. "Why is this not a mainstay of American agriculture?"