Colorado Plastic Products

By Eric Peterson / CompanyWeek | Jan 26, 2016

Company Details

Location

Louisville, Colorado

Founded

1969

Ownership Type

Private

Employees

6

Products

Plastic components for industries

Louisville, Colorado

Founded: 1969

Privately owned

Employees: 6

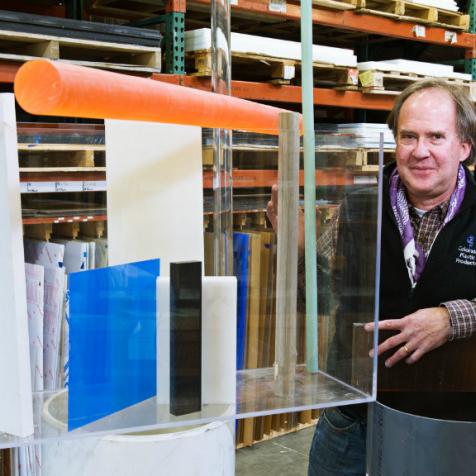

Owner Drew Schwartz is maintaining his company's independence in an increasingly consolidated industry with service and innovative materials.

Founded in Boulder by Dale Shaklee in the late 1960s -- before 30th Street was paved -- Colorado Plastics began as the plastics arm of a machine shop, but that setup meant it competed against its own customers. "They spun it off and it became Colorado Plastic Products," says Schwartz.

Ralph Ranson bought the company in 1978 and ran it for 27 years before selling to Schwartz, who'd worked in blood labs and acoustic wall panels before deciding to buy an existing business in Boulder County.

"I'm convinced there are three types of entrepreneurs," says Schwartz. The three subsets: startup specialists who guide a business up to $1 million in annual sales, mid-rangers who take companies from $1 million to about $10 million, and those who excel at taking a $10 million company up to $100 million in annual sales or more.

Schwartz says he based his acquisition on the perception he was one of the middle group and contacted 600 companies over a year and a half before buying Colorado Plastics in 2005.

"It fit all of the specs," says Schwartz of the decision. "One of the reasons I bought the business was because it was like walking into a company from the 1970s." He saw a lot of low-hanging fruit to modernize: "They didn't even have voicemail. They had a one-page website."

The company -- a distributor and a manufacturer -- is "a lumberyard for plastics attached to a furniture shop for plastic," explains Schwartz. With the steady blanks business supplying machine shops to artists, the company also fabricates high-end plastic cabinetry and chairs for such niche markets as research facilities and federal labs.

"The reason they are using plastics," he says of the latter markets, "is because it's non-corrosive, or because it's light, or because you can see through it."

Adds Schwartz: "Plastic guys don't buy metal and metal guys typically don't sell plastic, but our typical customer buys 80 to 90 percent metal and 10 to 20 percent plastic. We're always trying to find plastic substitutes for that metal." Schwartz recounts a job at Amgen where stainless steel proved to corrosive, so the pharmaceutical manufacturer turned to Colorado Plastics for polypropylene furniture.

"We're sort of the guys before or after injection molding," adds Schwartz, noting that the minimum order for injection molding is typically 1,000 units. "Unless you're going to make 1,000 of them, it's not worth spending $50,000 for the mold." Custom and low-volume pieces are a company forte: "Our sweet spot is five to 50."

Colorado Plastics stocks 50 kinds of plastic from 10 main suppliers. "Nobody makes all 50 kinds," says Schwartz. "The most anybody makes is 40."

Growth "has been steady, single-digit growth" in the decade Schwartz has helmed the company.

Challenges: "We sort of are like McGuckin versus Lowe's or Home Depot," says Schwartz. "The industry has consolidated quite a bit. For us to maintain our niche, we need to be higher service, higher flexibility guys."

Shipping is another hurdle. "We're dealing with bulky things," he says. "Logistics are definitely a challenge."

Opportunities: R&D facilities still represent a potential driver for growth, says Schwartz, and he sees opportunities in architectural products using multiwall polycarbonate. "Some people call it corrugated plastic," he says.

Schwartz says 3D printing is another intriguing market. "Some people see 3D printing as a threat to machine shops. I don't see it as a threat. I see it as a sidelight to what we do."

Exports represent another opportunity for the entire industry, he adds. "Plastic resins are a current account-positive in terms of international trade. We export a lot of plastics from this country."

Needs: "The hardest thing for us is to find skilled fabricators," says Schwartz. "You can't find young guys who want to learn the trade and old guys don't want to switch employers."

He also says the company has longer-term needs for more space and more automation. "The next thing we'll buy is a much more sophisticated router."